Reading Time: 5 minutesAgricultural businesses have withstood their fair share of COVID disruption – from family life to the workplace. While this has forced financial strain, labor disruptions, and tough decisions on producers, it has also ripened some opportunities where you might not expect them, including a Succession Plan.

In times like these, most family businesses quickly adjust by juggling roles and shuffling duties. We have seen junior high and high school kids step up and help keep the business running. This ‘all hands on deck’ attitude is unknowingly opening a window for successors to step up. When it comes to farm succession, finding the ‘window’ is one of the hardest parts, because unfortunately, most businesses often only find the window when there is sudden illness or death in the family – which then forces the family to unite and be forced to have the tough conversations that are typically avoided. As a result of COVID disruption however, there is the perfect opportunity to recognize those who have stepped up, and think through the implications long term to address what adjustments could be made.

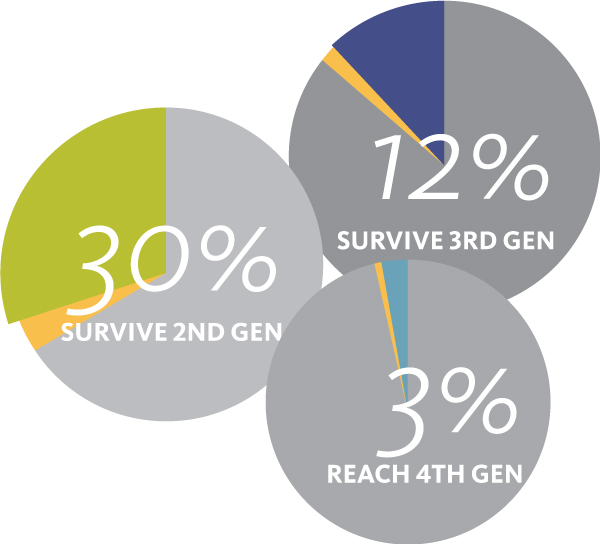

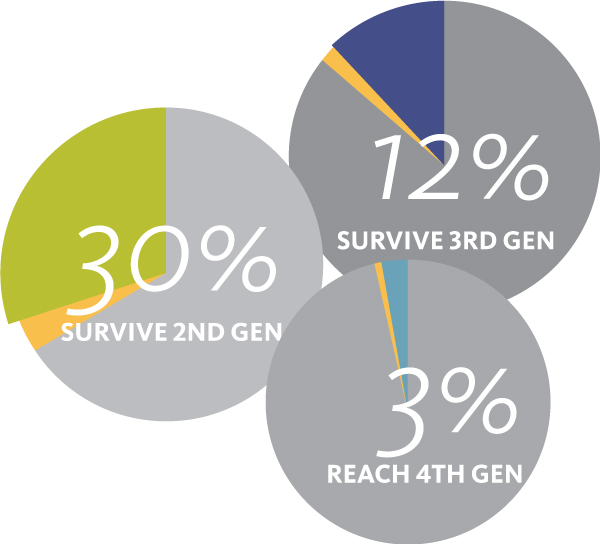

With a success rate of just 30% for transitions from the first to second generation of family agribusinesses, and even less chance for success (10% or less) as second and third generations attempt to transition, it’s staggering to see how little businesses take it seriously, and take action before they’re forced to. As succession planners, we can tell you, the true life stories are even more harrowing.

Choose Family Over Fear

“Change is never easy. You fight to hold on. You fight to let go.” – Daniel Stern, The Wonder YearsAs I am not here to instill fear from the fact that a first-generation business has a 70% chance of not surviving a transition, let’s discuss the reasons for this failure in an effort to facilitate your success. First and foremost, as the saying goes, ‘a failure to plan is a plan to fail.’ It’s important to acknowledge why 81% of family operations have no succession or transition plan. According to a study by Concordia University, 50% of family businesses feel it’s too early to think about it. Let’s face it, this is their baby and it’s what they love doing. Twenty-nine percent feel they cannot afford to take the time. We get it, you’re busy pouring your blood, sweat, and tears into keeping it running. The other 21% state they don’t have the proper advice or tools to get started. And for many, about 13% of respondents, the process is just too complex to tackle. Today’s disruption is forcing family businesses to make tough decisions now for the future of their business. Communication is critical, and openness to family to share in the decision process is necessary for success. It will be important to discern what items fall under a management decision, an ownership decision, and a family decision. Recognizing that different decisions will require different voices to weigh in is important to get through today, and plan for tomorrow.

Is it Too Early to Think about Succession?

“It’s never too early,” says Lance Woodbury, Pinion partner and family business advisor. “Your personal choices will always dictate what is a healthy timeframe for you and what you foresee for the business on your terms.” While some owners want to stay involved forever, others look forward to transitioning the day-to-day management of the business while being available to pass on wisdom when needed. And there are even a few who look forward to wiping the dirt from their hands and riding off into the sunset to pursue other interests.No matter when you intend to transition, remember that the business is more valuable – for your personal wealth and the longevity of the business for the family – if it’s running smoothly and you have the right management and successors in place should anything unexpected happen. Imagine these two scenarios. Scenario one: you’re 80 years old and your son has been involved in running the business for 20 years. Scenario two: you’re 80 years old and you oversee all operations and make all the decisions without the input of your family. You have had no discussion with your son or daughter on whether they desire or intend to take over the business. Even if you’re younger, and there’s less certainty for the future, it’s important to put a plan on paper for the future of your business. Leave yourself lots of room for flexibility in your plan as we know, like the weather, changing times can cause changes in business. Don’t let age deter you from taking advantage of the advanced planning techniques that can help build and transfer value to your business for its future and its stability to support your family. If situations change, you can easily adapt your plan.