“Cash is king” is an expression that has been used to refer to the importance of cash flow in the overall fiscal health of a business. While the many components of your operation’s financial health can be complex, often it can be the most simplistic things that can help generate cash.

Cash flow — the cash that moves in and out of your farm – is impacted by four key areas:

- Profitability

- Profit retention

- Financial leverage and

- Asset efficiency

We see it time and time again, when growers take their eyes off these key areas, their cash flow is impacted, and usually very quickly. Peter Martin, a finance and growth consultant for Pinion, advises farmers to monitor these areas of their operations to help boost cash flow in 2023.

Four Ways to Improve Your Farm Cash Flow

-

Examine expenses to increase profitability.

“The most successful farmers look at expenses – line by line – and cut the fluff. Follow suit and examine what you’re spending, not only for major inputs such as labor, seed, chemicals and fertilizers, but all expenses. The most profitable growers I work with drive down costs at every turn,” encourages Peter. Compare your expenses to what your competitors are paying. Your bank, your accountant and others can help you with those comparative numbers. Consider creating benchmarks against yourself to drive year-over-year cost reduction.

Pinion Pro Tip: Many businesses even engage third parties to examine their expenses, consider the necessities and point out if those costs are in, or out of line with what others are paying.

-

Focus on retaining profits for the next year.

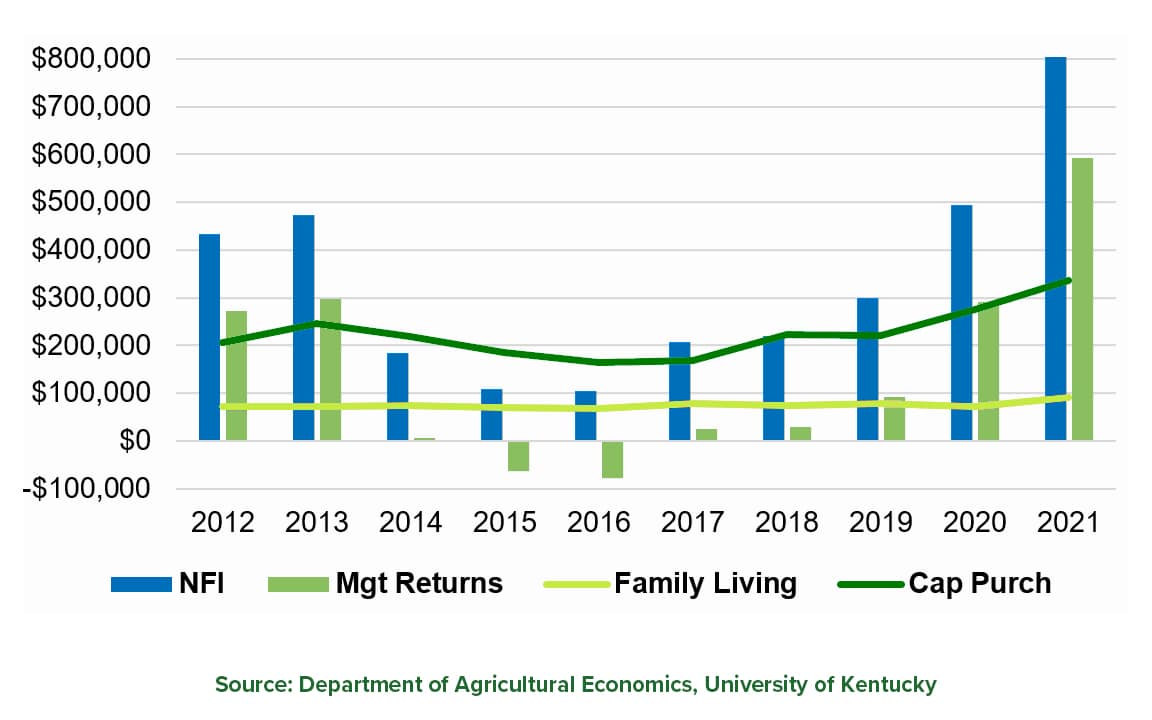

Just where are your profits going? A lot may be going into excessive family expenses. Farm families have raised their quality of living in the past decade, and rightfully so. But, if not so long ago you lived on $70,000 a year, and now that number has increased to $270,000 annually, a closer look is needed. In 2021, the average family farm living expenses hit $92,000, an almost 28% increase from 2020 (Figure 1). Paying for family members’ fuel, cell phone bills and other expenses can become expensive. These can quickly drain the profits from your company.

Figure 1: Income and Family Living Expenses

Pinion Pro Tip: You may want to continue providing these benefits, but to improve your farm cash flow, you’ll need to get clear on the true cost of these perks in your business. They are almost always higher than you think.

-

Clean up debt structure to gain more financial leverage.

Meet with your banker, and even a second lender, to learn about optimizing your debt structure. Has your operating line of credit gotten mucked up with old debt? Have you revisited your debt schedule recently? Now that rates are rising, have you revisited your plan for retiring debt? These are just a few of the questions you should be asking yourself about your financial leverage.

Pinion Pro Tip: Whether you’re in survival or growth mode, make sure your debt structure is optimized to maximize your borrowing capacity, collateral coverage and borrowing cost.

-

Home in on the efficiency of your equipment.

Consider whether you’re using your assets as wisely as possible. Do you have too much equipment? Did you buy a high-priced tractor? Your competition is likely doing more with less, so think twice about purchasing new equipment. Don’t be tempted to spend on things you don’t really need.

Pinion Pro Tip: Spend time studying whether you can trim your asset base to generate cash and improve your solvency. “Every farm I’ve visited has some old or underutilized equipment that could be sold to generate cash,” says Peter, “Always consider potential tax implications into these decisions.”

How are your farm or ranch cash flow projections looking for the year? Contact a Pinion advisor for help with cash flow strategies and adjustments for 2023.